CHRISTOPHER LIECHTY

STRATEGIC DEVELOPMENT

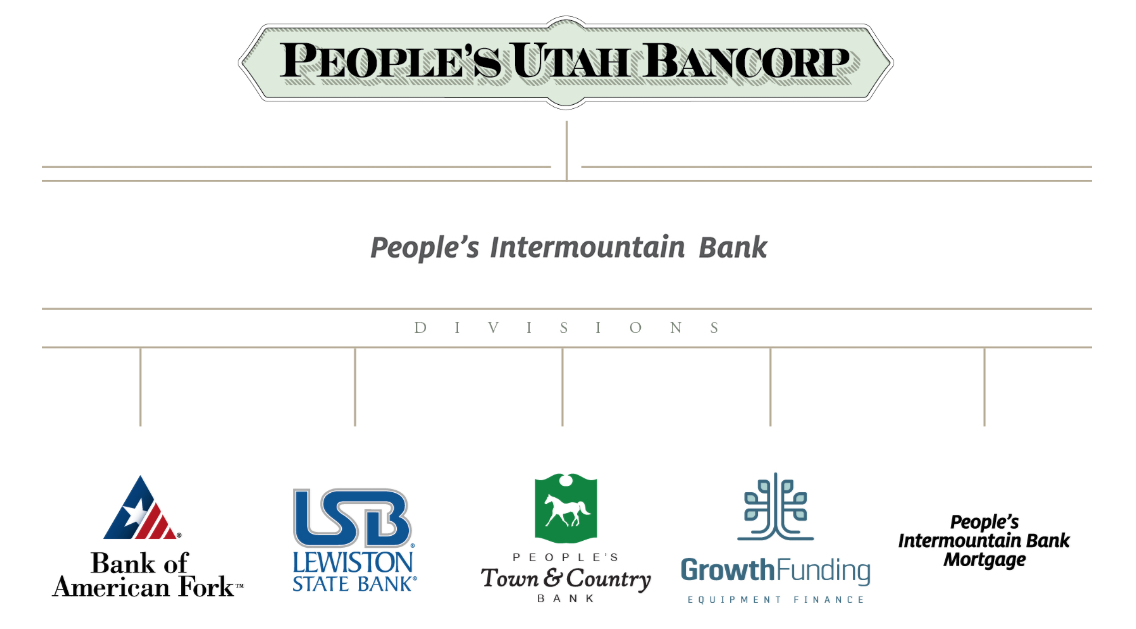

The following are a few accomplishments as a member of the corporate leadership team for People’s Utah Bancorp (Nasdaq: PUB), its subsidiary, People’s Intermountain Bank and its divisions:

Worked on leadership team that grew bank from $800 million to $2.4 billion in assets and through three acquisitions and Nasdaq IPO

Developed customer experience programs that helped to garner some of the highest Net Promoter Scores in the banking industry which is a directly correlated to employee engagement

Participated in various culture-change, product-development, process-improvement, major-project, expansion, and merger leadership teams for company with 500+ employees

Created multi-disciplinary product development (innovation) program that produced an average of four products per year from 2009 to 2016. The program is currently in redevelopment

Created “Talking Points” program to give employees guidance on critical issues. Employees have come to depend on these so much that they request talking points when issues begin to bubble up on the front lines

Authored dashboard and metrics systems to motivate teams and provide them with feedback on performance

Specialized in facilitative, “multiplier” leadership style, creating structure, setting the path and empowering teams to achieve goals with support as needed

Implemented CRM system, now actively in use 4+ years

Successfully managed teams and budgets for more than 20 years

Banking Services Development System

“In our first year of the program, we created, modified or eliminated 13 products. We learned that employees could not keep up with this pace of change and slowed down to an average of three products per year.”

In 2016, Christopher wrote about his experience in creating the Services Development Program at Bank of American Fork.

“It started with two of us. I had a team member with extraordinary skill in writing proposals that bridged the freedom of ideas with the rigor of a risk management officer. We started with the goal of producing proposal after proposal for the executive team to consider. It didn’t matter if any single proposal was accepted or rejected. We would have another proposal on the table and over time some would be accepted and we would be moving forward.

We had some successes early on. Management liked how we went from department to department to get input and feedback. We tried to think of every question management might ask, about profitability, demand, compliance, risk, etc. The proposals were actionable and they liked the process. After a few months, the COO approached us with a request to establish a committee. He directed us to invite a representative from each function of the bank. He presented us with the exact structure, the multidisciplinary team that we would have asked for. We believe this sprang from the structure of the proposals.

In our first year with the new Product Development Committee, we invited ideas from everyone in the bank. We visited various parts of the bank and looked for places where customers were having trouble meeting their needs. We reviewed our main product lines, and we closed little used products. In our first year, we either revised, launched or closed 13 products. Over the years, our pace has slowed, but over more than seven years, we launched or modified at least three products per year, which is much more manageable. Even this amount of change is a challenge for the organization to keep up with.

As one who studies human-centered design, I’m not sure our process matches up exactly with the ideal models, but it is working for us. We still don’t talk about the design process, but in the end, the results are really what we are after.

Age-Friendly Banking Program

This 2010 program to protect vulnerable seniors and individuals from financial abuse was the first of its kind in the banking industry. It has been presented at law enforcement, banking and elder care conferences across the US. Christopher was part of a small team at Bank of American Fork that has consulted with the US Bar Association, Barclays of London, The Province of British Columbia, the American Bankers Association, and the Consumer Financial Protection Agency to freely share learnings from program.

In 2009, Jilenne Gunther, an attorney from the State of Utah’s Division of Aging and Adult Services, approached us at the Bank of American Fork with some research she had recently published about an emerging problem with elder financial abuse. This was a topic that had not been little studied, but it was emerging as a major issue nationwide. Christopher and a small team from the bank worked with her to interview front-line bankers, families of victims and to explore a variety of banking solutions. After several iterations and prototypes, the product was launched in 2010. In fact, the Federal Consumer Financial Protection Bureau’s age-friendly banking program is largely based on the program above.

Ms. Gunther later moved to AARP where she has evolved the program into what is now AARP BankSafe which is being piloted for national release.